When you think about health insurance, a financial safety net that helps pay for medical care, including doctor visits, hospital stays, and prescription drugs. Also known as medical insurance, it’s not just about covering emergencies—it’s about making ongoing treatments like cholesterol meds, insulin, or thyroid pills actually affordable. But here’s the truth: having health insurance doesn’t always mean you can afford your prescriptions. Many people are shocked to find their plan covers the doctor visit but not the drug, or only covers the generic version—even when the brand-name drug works better for them.

That’s where prescription drugs, medications used to treat or manage chronic and acute conditions, from high blood pressure to depression come into play. Even with insurance, out-of-pocket costs for brand-name drugs can hit hundreds a month. Some plans force you to try cheaper generic drugs, medications with the same active ingredients as brand-name versions but sold at lower prices after the patent expires first. But if generics give you side effects or don’t work as well, you need to know how to push back—using documentation, research, and clear communication with your doctor. And if your insurance denies coverage altogether, you’re not stuck. Many Canadians offer the same medications at a fraction of the U.S. price, and some insurers even allow you to import them legally under certain conditions.

Then there’s the hidden side of insurance coverage, the specific list of drugs and services your plan agrees to pay for, often with restrictions like prior authorization or step therapy. It’s not just about what’s on the formulary—it’s about how it’s structured. Are you required to use a mail-order pharmacy? Does your plan cap how many pills you can get per month? Are there limits on refills? These rules can make managing a chronic condition feel like a full-time job. And if you’re on multiple meds—say, an immunosuppressant after a transplant or a fertility drug like clomiphene—you’re likely dealing with complex interactions that insurers don’t always understand. That’s why knowing your rights, tracking your drug history, and having a backup plan matters.

What you’ll find below isn’t a list of insurance plans or how to sign up. It’s a collection of real, practical stories and guides from people who’ve been there. You’ll read about how to convince your doctor to let you stay on a brand-name drug when generics fail. You’ll learn why some medications cost 10x more in the U.S. than in Canada, even when they’re the exact same pills. You’ll see how food like pomegranate juice or cannabis can interfere with your meds—and what to do about it. You’ll find out how to time your breakfast to make your ADHD meds work better, how to protect your gut when you’re on antibiotics, and why your insurance might deny a drug that’s medically necessary. These aren’t theoretical tips. They’re battle-tested strategies from people who’ve fought the system and won.

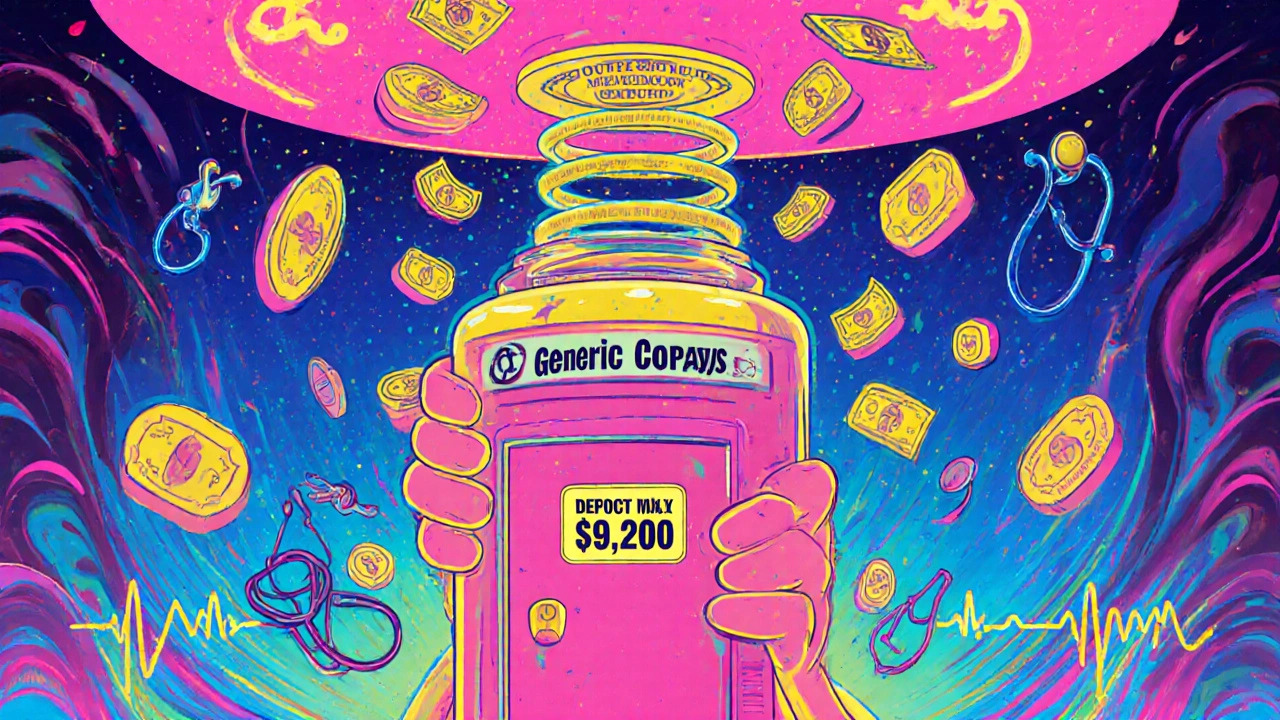

Generic prescription copays count toward your out-of-pocket maximum but usually not your deductible. Learn how this works, why it causes confusion, and how to track your costs correctly to avoid unexpected bills.