Every year, millions of Americans are blindsided by medical bills they never agreed to pay-bills that show up after an emergency, a routine procedure, or even a simple doctor’s visit. In 2022, 74.6 million people in the U.S. carried medical debt, according to the Kaiser Family Foundation. Many didn’t realize they were signing away more than just consent for treatment-they were also agreeing to financial terms they didn’t understand. That’s changing. New laws, especially in New York, are forcing healthcare providers to be clearer, fairer, and more transparent when it comes to how they treat patients’ money and personal information.

Separate Consent for Treatment and Payment

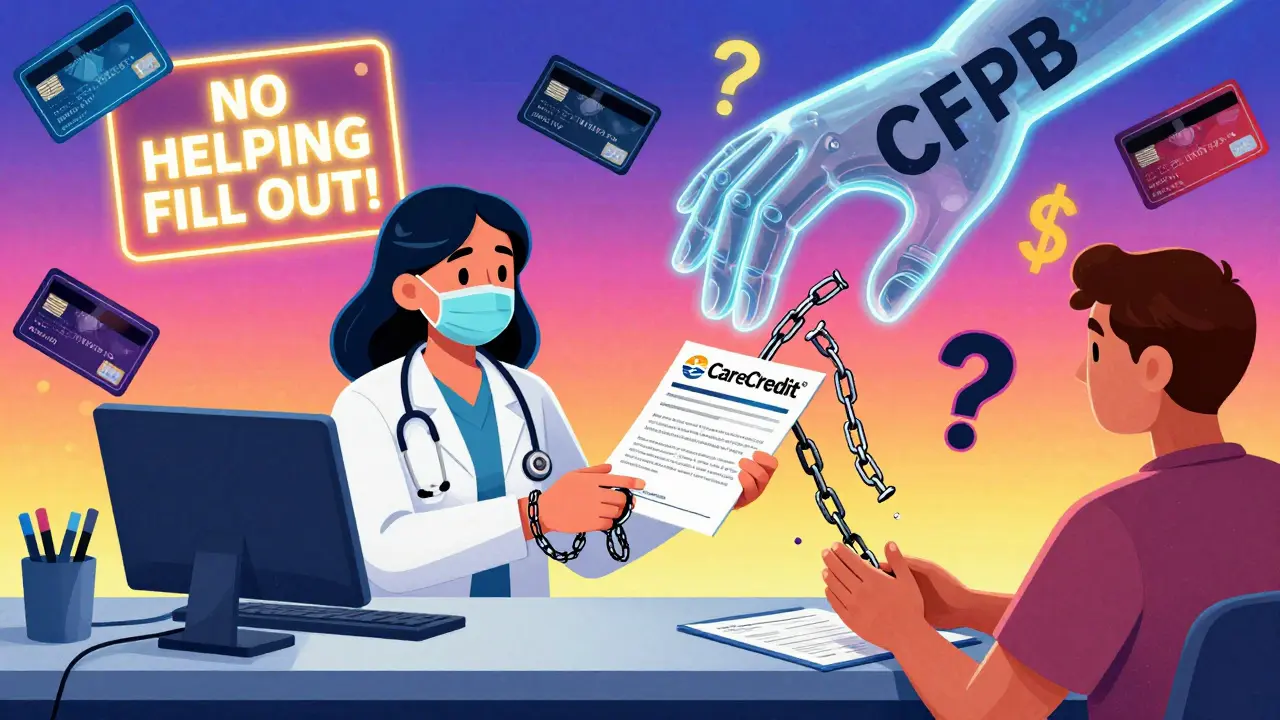

Before October 2024, it was common practice for hospitals and clinics to bundle everything into one form. You’d sign a stack of papers at check-in: consent for treatment, permission to share your records, and agreement to pay any costs not covered by insurance-all in one signature. That’s no longer legal in New York. Under Public Health Law Section 18-c, providers must now get two separate consents: one for your medical care and another for how they’ll collect payment. You can’t be forced to sign both at the same time. This change was made because too many patients didn’t realize they were agreeing to financing plans, credit applications, or payment arrangements just by signing a routine intake form. The penalty for violating this rule? Up to $2,000 per incident. That’s not a small fine. It’s meant to stop providers from hiding financial traps inside paperwork that looks like standard procedure.No More Filling Out Your Credit Applications for You

Have you ever been handed a CareCredit® application at the front desk and been told, “Just sign here, we’ll help you with the rest”? That’s now illegal in New York. General Business Law Section 349-g makes it clear: healthcare providers can’t complete any part of a patient’s application for medical financing. They can answer your questions. They can explain what CareCredit® is. They can even hand you the form. But they can’t fill in your income, your signature, or your contact details-even if they say they’re “just helping.” Why? Because when a provider fills out your application, they’re not just helping-they’re steering you toward a product that benefits them. Medical financing companies often pay providers commissions for each application they generate. That creates a conflict of interest. You might end up with a high-interest loan you didn’t fully understand, while the provider gets paid for pushing it. Violations can cost providers up to $5,000 per offense. And yes, the state is watching. Audits are already happening.Emergency Care Can’t Be Held Hostage for Your Credit Card

Imagine you break your arm. You go to the ER. The staff says, “We need your credit card on file before we treat you.” That’s not just rude-it’s now illegal under General Business Law Section 519-a. This law bans providers from requiring credit card preauthorization or keeping your card on file before giving you emergency or medically necessary care. Even if you’re uninsured, they can’t refuse to treat you until you hand over your card details. There’s another layer here: if you do pay with a regular credit card, you lose key protections. Medical debt from healthcare-specific financing (like CareCredit®) is covered by state and federal rules that prevent wage garnishment, liens on your home, or damage to your credit score. But if you use a regular Visa or Mastercard? Those protections vanish. You’re treated like any other consumer debt. That’s why providers now have to warn you in writing every time you use a traditional credit card for medical payments. The notice must clearly say: “Using a regular credit card for medical services may expose you to higher interest rates and fewer debt protections than healthcare-specific financing.”

How This Compares to Federal Laws

You’ve probably heard of the No Surprises Act, which took effect in January 2022. That law stops surprise bills from out-of-network providers. If you go to an in-network hospital but get treated by an out-of-network anesthesiologist, you shouldn’t get stuck with a huge bill. But the No Surprises Act doesn’t touch the financial practices we’ve just discussed. It doesn’t stop providers from asking you to sign a combined consent form. It doesn’t stop them from helping you fill out a CareCredit® application. It doesn’t stop them from asking for your credit card before treatment. New York’s laws go further. They target the everyday financial traps patients face-even inside in-network care. That’s why legal experts call them some of the strongest patient protection laws in the country. The Consumer Financial Protection Bureau (CFPB) also made a major move in 2024: it banned medical debt from appearing on credit reports. That’s huge. Before this, a $300 unpaid bill for a lab test could tank your credit score. Now, it can’t. But this rule only applies to debt reported to credit bureaus. It doesn’t stop collectors from calling you, suing you, or putting liens on your property. New York’s laws help fill those gaps.What This Means for Patients

If you’re a patient in New York, here’s what you can expect now:- You’ll get two separate forms at your appointment: one for treatment, one for payment.

- No one will fill out your financing application for you-even if they say they’re “just helping.”

- You can’t be denied emergency care because you don’t have a credit card on file.

- If you pay with a regular credit card, you’ll get a written warning about the risks.

- You have the right to ask for a copy of your signed consent forms.

What This Means for Providers

For doctors, clinics, and hospitals, these laws mean major changes. Staff training is no longer optional. Forms must be redesigned. Policies must be updated. Records must be kept to prove compliance. Many providers are struggling. The New York State Department of Health released its official guidance just two days before the laws took effect. That gave clinics less than 48 hours to retrain staff, update forms, and change workflows. Some parts of the law are still unclear. For example, Public Health Law Section 18-c was suspended in August 2025, creating confusion about whether separate consent is still required. Until further notice, providers are advised to assume the rule is still in effect. The risk of being fined is too high to ignore. The bottom line: compliance is expensive, but non-compliance is costlier. Fines add up fast. And reputational damage? That’s harder to fix.What’s Next?

New York isn’t alone in this push. Other states are watching closely. Legal experts predict that within the next two years, similar laws will appear in California, Illinois, and Massachusetts. The CFPB’s credit report ban and New York’s consent rules are setting a new national standard. The trend is clear: medical care shouldn’t come with hidden financial traps. Patients deserve to know exactly what they’re signing. They deserve to be treated with dignity-not as a source of revenue. If you’re in New York, know your rights. If you’re elsewhere, ask your provider: “Do you use separate consent forms for treatment and payment?” If they don’t know what you’re talking about, they might not be following the law-even if it’s not in your state yet. This isn’t just about paperwork. It’s about power. Who controls the conversation when you’re sick and vulnerable? For too long, it was the provider. Now, it’s starting to shift-back to you.Can a doctor refuse to treat me if I don’t sign a payment consent form?

No. Under New York law, providers cannot deny emergency or medically necessary care because you refuse to sign a payment consent form. You have the right to receive treatment first and discuss payment options later. This applies even if you’re uninsured or have no insurance.

What’s the difference between CareCredit® and a regular credit card for medical bills?

CareCredit® and other healthcare-specific financing products are designed for medical expenses and come with state and federal protections-like limits on wage garnishment and no impact on credit scores if you’re in hardship. Regular credit cards don’t offer these protections. If you use a Visa or Mastercard for medical bills, you’re treated like any other consumer debtor, which means collectors can sue you, put liens on your property, or garnish your wages.

Are these laws only in New York?

As of 2026, these exact rules are only in effect in New York. But they’re being closely watched by other states. The CFPB’s 2024 medical debt rule and New York’s consent laws are setting a new standard. Experts predict California, Illinois, and Massachusetts will pass similar laws within the next 12 to 24 months.

Can I be charged interest on medical bills if I pay with a credit card?

Yes. If you use a regular credit card, the card issuer can charge you interest just like any other purchase. Some providers offer interest-free payment plans directly, but those are optional. Always ask if the provider offers a payment plan before using a credit card. You may avoid interest entirely.

What should I do if a provider violates these laws?

Document everything: take photos of forms, save emails, write down names and dates. Then file a complaint with the New York State Department of Health and the Consumer Financial Protection Bureau. Both agencies have online portals for reporting violations. You can also contact a patient advocacy group like the Patient Advocate Foundation for free legal guidance.

TONY ADAMS

January 25, 2026 AT 07:04Bro, I got billed $800 for a Band-Aid last year. They made me sign like 10 pages and I didn’t even know I was agreeing to pay for the janitor’s coffee. 🤡

rasna saha

January 26, 2026 AT 13:52This is so needed. I had a panic attack signing forms at the ER last year-felt like I was signing my soul away. So glad someone’s fighting for patients.

Take your time. Ask for copies. You’re not in a rush.

Faisal Mohamed

January 27, 2026 AT 01:03Let’s deconstruct the ontological weight of medical consent as a performative act of neoliberal subjugation. The clinic isn’t a healing space-it’s a financial interface where vulnerability is commodified via contractual obfuscation.

Section 18-c’s suspension in Aug 2025 reveals the fragility of regulatory performative compliance. The state’s enforcement apparatus is performative, not substantive. We’re witnessing the spectral haunting of consumer sovereignty.

Meanwhile, CareCredit® operates as a neoliberal siren song-low APR bait, high-interest trap, with providers receiving kickbacks like medieval toll collectors.

CFPB’s credit report ban? A band-aid on a hemorrhage. Debt collectors still roam the night. The real power shift? When patients start refusing to sign anything without legal counsel. 🤖💸

James Nicoll

January 27, 2026 AT 09:23So New York’s finally catching up to the 21st century? Took ‘em long enough.

Meanwhile in Texas, they’re still asking if you want to ‘upgrade’ to a $2,000 MRI package while you’re on the gurney. 🙃

Ashley Porter

January 28, 2026 AT 19:48My mom got hit with a $12k bill after a routine colonoscopy. She didn’t even know the gastroenterologist was out-of-network. They just handed her a stack of papers and said ‘sign here.’

These laws are basic human decency. Not revolutionary. Just… necessary.

John Wippler

January 28, 2026 AT 23:14Let me tell you something real: when you’re lying in a hospital bed, dizzy from painkillers, and someone says ‘just sign here,’ you’re not signing a form-you’re signing your dignity away.

These laws? They’re not bureaucracy. They’re armor.

Every time a provider says ‘we’re just helping you fill this out,’ they’re not helping-they’re exploiting your weakness.

And yeah, I’ve been there. I signed the wrong thing. Got saddled with a 14% CareCredit® loan for a $300 blood test.

Now I carry a laminated card in my wallet that says: ‘I do not consent to bundled financial agreements. I need 24 hours to review. Do not proceed without my written confirmation.’

It’s not paranoia. It’s survival.

And if you’re reading this and you’re not in New York? Ask your provider. Right now. Ask them. If they look confused? They’re probably breaking the law.

Power isn’t given. It’s claimed.

Claim yours.

Kipper Pickens

January 30, 2026 AT 08:56Interesting how the CFPB’s credit report ban and NY’s consent laws are creating a bifurcated regulatory landscape-federal action on reporting, state-level intervention on procedural ethics.

But the real tension lies in enforcement asymmetry: while fines are steep, patient awareness remains low. Most don’t know their rights until they’re already in collections.

Also, the suspension of 18-c? That’s not a loophole-it’s a warning sign. Regulatory instability breeds compliance fatigue. Providers will exploit ambiguity until the next audit cycle.

And let’s not forget: CareCredit® isn’t a product. It’s a revenue stream disguised as a service. The commission structure is a classic principal-agent problem. The provider’s incentive is misaligned with patient welfare.

Bottom line: transparency without enforcement is theater. We need audits, not just laws.

Aurelie L.

January 31, 2026 AT 12:23Oh good. More paperwork. Now I have to sign two forms instead of one. How revolutionary.

Meanwhile, my insurance still won’t cover the actual doctor. 🙄

Joanna Domżalska

February 1, 2026 AT 07:41These laws are just performative activism. You think patients care about separate consent forms? They just want their pain to go away.

And let’s be real-most people won’t read the fine print anyway. This is just virtue signaling for urban progressives who think paperwork fixes capitalism.

Also, CareCredit® is fine. It’s not like you’re being forced to use it. If you’re dumb enough to sign without reading, that’s your fault.

Stop treating patients like children.

bella nash

February 1, 2026 AT 10:15It is imperative to underscore the formal legal architecture underpinning Public Health Law Section 18-c and General Business Law Section 349-g. These statutes constitute a codified reclamation of patient autonomy within the clinical encounter. The procedural bifurcation of consent mechanisms represents not merely administrative reform, but epistemological reorientation: the patient is no longer a passive object of clinical-administrative procedure, but an active subject of contractual negotiation.

One must also acknowledge the jurisprudential precedent set by the CFPB’s 2024 regulatory intervention, which decouples medical indebtedness from creditworthiness-a profound shift in the moral economy of healthcare finance.

Nonetheless, the suspension of Section 18-c in August 2025 introduces a critical jurisprudential ambiguity that may undermine the integrity of the entire regulatory framework.

It is therefore incumbent upon all stakeholders to maintain meticulous documentation and to insist upon compliance, regardless of administrative uncertainty.

Compliance is not optional. It is a moral imperative.

Geoff Miskinis

February 2, 2026 AT 13:06Oh, so now we’re treating patients like fragile porcelain dolls who can’t handle a piece of paper? How quaint.

And let’s not forget: if you can’t read a consent form, maybe you shouldn’t be allowed to drive, vote, or buy alcohol either. This isn’t protection-it’s infantilization.

Also, CareCredit® is a $20 billion industry. You think the providers are the villains? The real villains are the banks that created it. Blame the system, not the clinic staff who are just trying to get through their shift.

Betty Bomber

February 4, 2026 AT 04:38My aunt got denied care in Florida because she didn’t have a card on file. They told her to ‘come back when you’re ready.’

These laws should be federal. No one should be turned away because they’re broke. Period.

Renia Pyles

February 4, 2026 AT 08:14Ugh. More woke legislation. Next they’ll make us sign a form saying we won’t cry during surgery.

People are adults. If they can’t read a contract, that’s their problem. Stop coddling them.

Also, I’ve used CareCredit®. It saved me $3k on my knee surgery. Don’t hate the product because you’re bad at math.

John Wippler

February 4, 2026 AT 10:51And yet, the ones screaming ‘adults should read the fine print’ are the same people who never got a bill for $800 for a Band-Aid.

Try being in the room when you’re shaking from pain, your kid’s in the ER, and the clerk says ‘sign here.’

It’s not about being dumb. It’s about being human.

And if you think a $5,000 fine for a provider is ‘woke,’ you’ve never had your credit score crushed by a $200 lab bill.

This isn’t coddling. It’s justice.

And if you’re still mad? Maybe you’re not mad at the law.

Maybe you’re mad that you didn’t know your rights.

And that’s the real tragedy.